Is it a good time to buy a home?

Headlines are saturated with real estate being un-affordable and overvalued. It is true, that affordability has eroded in Toronto's real estate market. Per RBC's August Housing Trends and Affordability August 2015 report, a two-storey home requires 67.5% of a person's income based on 25% down payment, mortgage amortization of 25 years at 5 year fixed rate.

What does 67.5% mean?

Let's assume someone makes $100,000 annually, they are taxed at 27% (federal and provincial) leaving $73,000 annually ($100k less $27k taxes) to pay for the housing costs (67.5% per the report) which nets $5,500 to live off for the whole year! Basically, 2 incomes are required to buy a two-storey home in the city of Toronto.

Should you buy with 5% down?

A dilemma first time home buyers face; should you jump in the market now or wait till.........

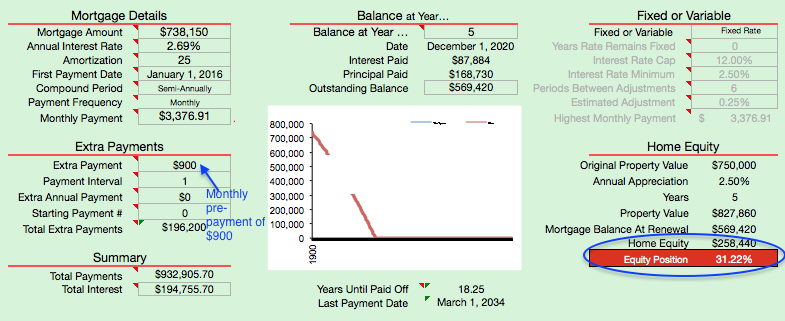

Here is the math on buying a $750,000 home (most probably a semi-detached or townhouse in the city of Toronto)

Purchase Price: $750,000

5% Downpayment: $37,500

Closing Costs (land transfer taxes & legals): $19,000 approximately

Total Required Capital: $56,500

The mortgage of $738,150 includes CMHC premium of 3.6%. Based on 2.5% appreciation, keeping up with inflation, the home equity in 5 years once the mortgage renews is $200,731 from the original investment of $56,500. That's a 51% return annually!

But That's Forced Savings

That's very true. Paying down the mortgage is a forced savings program, but I don't recall any savings accounts in the marketplace advertising a double digit return, more like 1-2%.

We Are Not Comfortable Paying $3376 Monthly For A Mortgage

Neither am I but there is solution: what if you purchased a semi-detached with basement suite? Depending on the basement suite condition and location of the property, rents can range from $850-$1200 for a one bedroom basement suite. For every $450 of rental income, $100,000 of the mortgage is covered. For example, if you are getting $900 in rental income, the tenant covers $200,000 mortgage payment and you are paying for the difference ($538,150). If you are comfortable paying $3376 monthly mortgage and use $900 per month to pre-pay the mortgage, your home equity would be $258,440 or 31.22%

The Power of 2.5% Appreciation

Let's forget market appreciation of 5% or 9% and use only 2.5% which is in line with inflation. Your original equity position of 1.4% (5% downpayment less 3.6% CMHC insurance premium) in 5 years at 2.5% appreciation results in 24.25% equity position ($200,731). You would be in a position to pull some equity to buy your next home and keep your existing home an investment property with both units tenanted.

Homeownership is not for everyone but real estate can be part of your long term wealth creation.