Toronto's real estate market has been hot for many years due to lack of supply and low interest rates. Many homes and investment properties get swept away in multiple offers in a short period of time which has frustrated buyers.

We have had clients inquire about buying residential investment properties (duplexes or triplexes) on busy streets as an option due to lack of supply and losing out on multiple offers. Is this a good option?

Questions to consider when evaluating investment property potential:

- Traffic impact (noise and pollution) on property value and rentability

- Community feel: Would the tenant feel like they are part of a community/neighbourhood?

- Rental income demand: Can investment properties located on busy streets demand rental incomes as high as other properties?

- Tenant profile: Would a high quality tenant be attracted to living on a busy street?

- Exit strategy: How easy (what's the demand) will it be to sell when it is time to liquidate the investment property? Which buyer profile would be attracted to buying on a busy street?

Let's look at data with respect to saleability of properties on busy vs less busy streets.

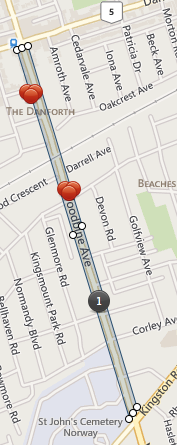

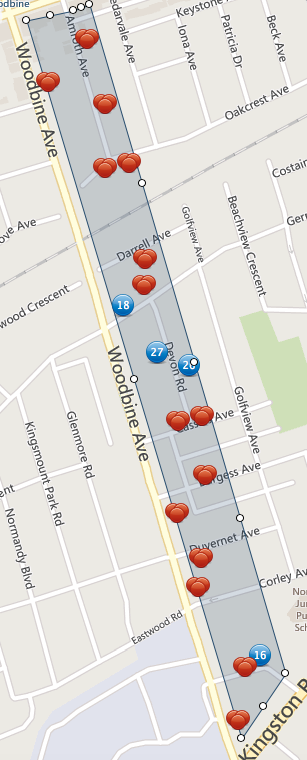

The study is comparing 2 years sales of properties located on Woodbine Ave from Kingston Road to Danforth Ave (figure 1) vs properties located parallel to Woodbine on the east side (figure 2)

We looked at 2 years sales history to smooth out any seasonal or market fluctuations. Here are the findings:

Properties on Woodbine

- Average sale price: $568,933. Median price: $553,050

- Average days on market: 27. Median days on market: 20

Properties Beside Woodbine

- Average sale price: $619,060, median price: $590,950

- Average days on market: 16. Median days on market: 9

Summary

- Average price difference: $50,127, Median price difference: $37,900

- Average days on market: 11. Median days on market: 11

The data shows properties (homes or investment) located on busy streets are lower in price and require more days on market to sell.

The cost of financing/carrying an additional $50k in price is around $200 per month. The investment property located on the non-busy street needs to generate $200 or more in rental income per month to be worthwhile.

When investing in real estate, it is not about getting a property, it is important to consider the operational aspect and the exit strategy.

To find out about turn-key investment property system, we can be reached via email or social media.