Get 23% ROI annually and sleep better at night without worrying about market corrections

Choose Your Advisor First

What Should You Do With Your Investment Property Cash Flow?

Im Buying an investment property is similar to buying a business; it needs to cash flow. Would you buy a business that loses money on a monthly basis? Probably not and you shouldn't buy an investment property that negative cash flows.

Now that we agree cash flow is critical, what should you do with the monthly cash flow surplus?

Let's assume the property cash flows after expenses and reserve fund allocation, $500. We encourage our clients to allocate a minimum of 8% of rental income for repairs, maintenance and vacancy allowance. For a property that generates $3,500 monthly, $280 is set aside.

There are 2 options to consider for the net $500 monthly cash flow:

1. Prepay investment property mortgage

2. Prepay principal residence mortgage

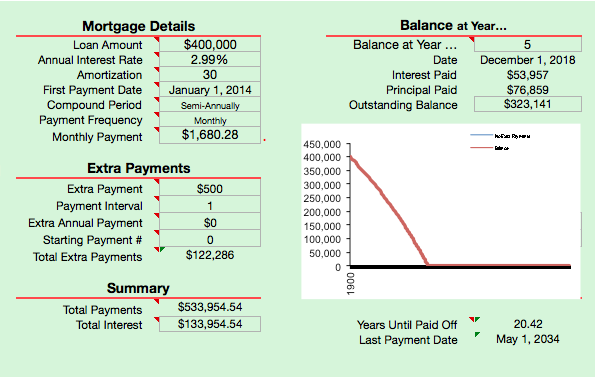

Assume your principal residence mortgage balance is $400,000 borrowed at 2.99% and amortized over 30 years with a monthly payment of $1,680.28. By diverting $500 monthly into your principal residence, the mortgage amortization is reduced to 20.42 from 30 years, saving you 9.6 years or $193,568 of mortgage payments.

Imagine having no mortgage payment!

Another factor to consider is tax efficiency (disclaimer: consult a professional accountant for tax advice, we are not accountants). The interest portion of a principal residence mortgage, for majority of homeowners, is not tax deductible. Whereas the interest portion of the investment property mortgage is tax deductible. A sound financial strategy is to pay off non tax deductible debt first.

Once the principal residence mortgage is paid off, use the rental property surplus to pay down the investment property mortgage to increase cash flow and pay it off ahead of the original amortization.

Questions? We can be reached via email or social media.

Flip The House.....Later

Buying a house, doing some work to it and selling it for $100,000 profit a few months later sounds like a lucrative proposition, but is it really?

Canada Revenue Agency will tax the profit as income not capital gains. In this instance, the full $100,000 profit would be taxed at your marginal tax rate.

Here is an example of why I prefer to flip the house.....later: Buy, Add Value, Refinance (BAR) then hold

Buy & Add Value

- Property purchase price $500,000

- Downpayment, closing costs & 4 month carrying costs: $113,000

- Renovations: $100,000

Refinance

- Refinance property at $600,000

- New Mortgage (80% of value): $480,000

- Total Capital (including closing costs): $144,609

Hold

- Hold property for 5 years

- Annual appreciation: 3%

- Annual ROI w/ cash flow: 18.55%

- Property equity after 5 years: $237,438

If property is sold after 5 years, only 50% will be taxed at your marginal tax rate. Assuming a sale price of $675,000, only $87,500 out of the $175,000 ($675,000-$500,000 divided by 2) would be taxed at your marginal tax rate. Disclaimer: Always consult a professional accountant who specializes in real estate investment to guide you through CRA's rules and regulations. Capital Costs Allowance are not taken into consideration in this example.

To summarize the 2 options:

1. Sell Now: $100,000 profit taxed at marginal rate

2. Sell in 5 Years: $237,438 profit (difference between property value and remaining mortgage balance) plus $41,588 in cash flow over 5 years, only $87,500 taxed at marginal tax rate

Advanced real estate investor tip: Don't sell the property after 5 years, refinance it to pull equity to buy another investment property which would defer paying capital gains taxes to a future date and build portfolio by acquiring another investment property.

To answer your questions or to put your financial freedom plan, we can be reached via email or social media.

Paydown Investment Property Or Access Equity?

You bought an investment property 5 years ago and it's time to renew the mortgage. Should you renew the mortgage or refinance to pull equity to buy another investment property? This is a common question we get from our investor clients (This question is applicable to your home mortgage as well).

Here is an example to best illustrate the options:

Current Property Value: $720,000

Mortgage Balance: $465,000

Option 1 - Pull Equity to 80%: new mortgage $576,000 amortized over 35 years. Access $111,000 of equity to acquire another investment property (35 year amortization is available for investment properties)

Option 2 - Renew mortgage at current remaining amortization and mortgage balance remains unchanged at $465,000

If the real estate investor is in acquisition phase, it is best to proceed with option 1. This also provides a tax advantage; the interest costs for the additional $111,000 are tax deductible since it is used for investment purposes (disclaimer: consult an accounting professional for tax advice). A key point to consider when deciding how much equity to pull out of the investment property is to stress test the cash flow using higher interest rates to ensure the investment property will not negative cash flow in the future.

If the real estate investor has completed acquiring the number of properties required per the plan, it is best to proceed with option 2 to pay off the investment properties and increase passive income.

Having a plan upfront helps you, the real estate investor, in knowing how many properties are required to achieve your long term financial goals and deciding what to do at mortgage renewal time.

Questions? We can be reached via email or social media.

How Many Investment Properties Do You Need?

Over the years working with real estate investors, I have come across very interesting answers when I ask "How many investment properties do you need to buy?" I have heard from 1 property to 40 properties, 1 every year for the next 5 years, don't know... Most stumble when I ask why? It starts with why. Simon Sinek explains the importance of starting with why in his TED Talk

There are many reasons for buying investment properties, here are some:

- Retirement income

- Fund children's post secondary education

- Job replacement (one spouse might be considering leaving their job)

- Supplemental income

- Family legacy

- Full time real estate investor

- Investment diversification (real estate and stock market)

Once a reason or multiple reasons are chosen, determining how much monthly income the investment properties are to generate is the next step. This goal can be achieved via different investment properties options (single family, duplex, multi-family, commercial....) and various geographic locations.

To complete "why invest in real estate" analysis, reverse Engineer the number of properties you need and have your personalized "how and where" plan developed, click here.

What Is Mortgage Increase And Blend?

Homeowners are taking advantage of historic low interest rates whether they are fixed, around 3%, or deeply discounted variables around prime less 0.5%. Majority of homeowners and real estate investors choose a 5 year term, but what happens in the future if it is required to increase the mortgage amount for the purpose of debt consolidation, equity take out for investment purposes, or moving to a new home?

Home Equity Take Out Options

Example: Property value $480,000. Current mortgage balance is $250,000 at 3.09% with 3 years remaining till maturity and the homeowner wants to borrow $150,000 to buy an investment property. There are 3 options for the homeowner to entertain:

- Break the mortgage and restructure up to 80% based on current market value. Con: paying a penalty and refinancing at a higher interest rate (assuming interest rates will not be at 2.99% in 3 years time)

- Add a HELOC up to 80% of current market value: HELOCs are offered at prime+0.5%. Good option since it is setup separately and interest costs can be easily tracked for income tax deductions

- Increase & blend: Leaving the current mortgage at 3.09% unchanged, the homeowner can add another $150,000 to the mortgage based on current mortgage interest rates with the new mortgage maturing at the original date. In this case, a 3 year fixed term would the product choice.

The above illustrates the options for a fixed mortgage holder. The options are different for variable mortgage holders:

- Refinancing the mortgage with the penalty being 3 month interest

- Adding a HELOC up to 80% of current home value

- Increase and blend is not an option lenders offer. To my knowledge only one lender allows increase and blend for variables. ING Direct used to allow it, however that might have changed after the acquisition by Scotiabank and renaming to Tangerine

One thing to look out for is the fine print detail for no frills mortgages (ultra low rates) as some might restrict the homeowners ability. For example, BMO's 2.99% offer allowed the homeowner to refinance only with BMO and did not allow adding a HELOC. Since the homeowner has no negotiating power they are at the mercy of the bank when it comes to interest rates.

There is more to mortgages than interest rates. Rates are the cost of getting into the mortgage, however the fine print can cost thousands more.

To navigate through the mortgage minefields and for a hassle free transparent experience please contact Nawar.

The Fine Print Of 2.99% Mortgage Rate

It is that time of year again....spring market. This is when the majority of real estate transactions occur and hence when the banks tend to get aggressive on mortgage pricing to gain market share.Another 2.99% offer was made by BMO which was in the headlines across various media outlets. My objective in writing this article is to explain the fine print of BMO's mortgage. In 2014 homeowners ought to expect more transparency and explanation from their mortgage professional or bank employee.

Here are the fine print details of the 2.99% offer:

- 25 Years Maximum Amortization: It is advantageous to payoff your home early, however one size does not fit all. If the homeowner, intends to buy an investment property, cottage or a second home in the future, the higher mortgage payment due to the lower amortization would restrict mortgage qualification. Other cases where 25 year amortization is disadvantageous are: self employed homeowner, family that's expecting a child and income will drop due to maternity leave, family that has to support a child through university, single parent, homeowner who is looking to leave their job and start a business......

- Pre-Payment Privileges: 10%. Although the majority of lenders offer 15%-20% pre-payment privileges, I believe 10% is decent since majority of homeowners do not max out that privilege

- Increase Payment Privilege: 10%. Decent but again, not the best in the industry (15%-20%).

- Fully Closed Term: This is where BMO has their clients locked up. The homeowner can get out of the mortgage if they sell the home via bona fide sale (arms length sale) or refinances with BMO. In negotiations, if one has only option or entity to negotiate with they would not be in position to get a good deal. The interest rate differential (IRD) for this mortgage product is punishing since it is 2% below the posted rate (4.99%) and it's equivalent to approximately 4% of the outstanding balance.

It is important for homeowners to sit with their mortgage professional and ask about the cost of getting into the mortgage (interest rate) and inquire about the costs of getting out of the mortgage (penalties, portability, restrictions). A mortgage is one piece of the puzzle in a homeowner's financial plan and it is important to ensure the right product is chosen based on features and not just rates.

What Is The Mortgage Qualifying Rate (MQR)?

The mortgage qualifying rate is used to qualify all variable mortgages and fixed mortgages of 1-4 year term. The Bank of Canada updates the mortgage qualifying rate (MQR) every Monday at 12:01am. 5 year fixed or longer fixed terms qualify using the contract rate (the actual borrowing rate). Here is an explanation:

Mortgage Qualifying Rate Example

Assumptions

- Household income: $100,000

- Assume 20% downpayment

- Freehold home, no condo fees

- 5 year fixed mortgage 3.19% amortized over 30 years

- 5 year variable mortgage at prime - 0.5% amortized over 30 years

- Mortgage qualifying rate (MQR): 4.99%

Maximum fixed mortgage: $577,000 (Purchase price: $721,250) Maximum variable mortgage: $466,000 (Purchase price: $582,500)

One way to increase the purchase power of a variable or fixed mortgage is obtain a 35 year amortized mortgage. Once the homeowner takes possession of the home, they can set the payment at the 30 year amortization level to avoid paying additional interest over the life of the mortgage.

To find out what you qualify for and a have a winning strategy for bidding wars, please contact Nawar.

CMHC Insurance Premium Increase

On February 28, 2014, CMHC announced mortgage insurance premium will increase effective May 1, 2014 for homeowners, self employed and 1-4 rental properties.Here is a chart of the current and new insurance premiums for owner occupied homes

What exactly does this increase translate into dollars and cents? Here is an example based on 5% downpayment, 3.49% mortgage amortized over 25 years

As you can see the increase is moderate ($8.98 per month) and should be manageable by homebuyers. It will be interesting to see what happens in the future since CMHC stated they will review insurance premiums annually and make announcements in the first quarter moving forward.

Genworth wasted no time in announcing similar increases to their premiums effective May 1, 2014. Canada Guaranty took a few days to mull over their decision but they will increase their insurance premiums as well.

[contact-form subject='I Have A Question...'][contact-field label='Name' type='name' required='1'/][contact-field label='Email' type='email' required='1'/][contact-field label='Comment' type='textarea' required='1'/][/contact-form]