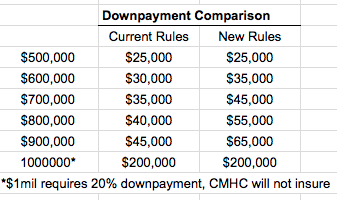

Minister of Finance announced the downpayment rules effective Feb. 15, 2016 will increase for homes over $500k.

The first $500k or homes for less than $500k downpayment requirement will remain at 5%.

How Will This Affect Toronto's Real Estate Market?

Per Toronto Real Estate Board November Market Watch report, average condo price in C01 is $465,201 and in C08 is $459,043. Both are under $500k which would not be affected by the new downpayment rules.

What If I buy with 5% Today?

Will the new downpayment rules affect first time home buyers moving up the homeownership ladder? Let's see what happens if a first time home buyer buys with 5% downpayment.

- First time home buyer buys an average priced condo in C01 downtown Toronto: $465,201

- Downpayment 5%: $23,260

- Mortgage: $457,851 including CMHC insurance premium amortized over 25 year at 2.79% 5 yr fixed

- Assume 2.5% appreciation (condos appreciated 5.4% year over year based on TREB's November market watch report

In 5 years, at mortgage renewal assuming 2.5% appreciation, the equity position is

Condo Equity Position In 5 Years

Assuming selling costs of 5%, the condo owner will have $110k for their next purchase. Based on the downpayment comparison chart, the buyer will be able to buy up to $999,999 pending qualification.

Conclusion: I don't see how this will slow down the Toronto Real Estate market....time will tell.

If you are looking to work with well informed full time real estate professional who will not rush you into buying, we'd love to help.