Toronto real estate prices have been increasing for what seems like forever for numerous reasons; economic, employment, government policies and global events. With record sales and prices reported on a regular basis, should you buy an investment property in Toronto or consider other cities?

Let's look at a real deal recently done for a duplex investment property.

Semi-detached duplex in Toronto

Purchase Price: $875,000

Required Capital: $204,350 (downpayment + closing costs)

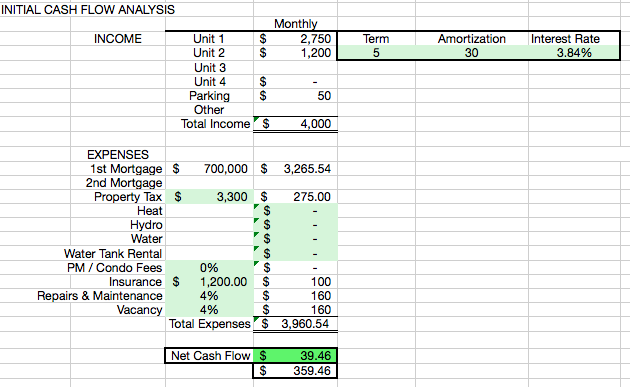

Mortgage: $700,000 (80% of $875,000)

Rental Income: $2,750 (main/upper unit) + $1,200 (lower unit) + $50 parking

Annual Property Tax: $3,300

Annual Property Insurance: $1,200

8% reserve fund for repairs, maintenance and vacancy

The actual financing done on the property was a variable mortgage, however for this case study we will assume a 10 year fixed rate to allow for higher rates in years 6-10 for analysis purposes.

Here is the initial cash flow analysis

After 10 years assuming annual rent increase of 1% and expenses increase of 3% with a conservative 3% annual property appreciation:

Property Valuation: $1,141,677

Mortgage Balance: $568,580

Equity: $573,096

Annual Return on Investment: 18%

The $204,350 initial capital investment has turned into $573,096 in 10 years! Toronto's real estate prices have been appreciating at more than 3% annually, however using a conservative figure to average out the peaks, the corrections and the flat periods, 3% annual appreciation results in almost tripling the initial investment. This is why 2 Toronto investment properties is all you need to achieve financial freedom (Download E-Book).

Although Toronto real estate prices are high, opportunities do exist for cash flow and long term wealth creation. Want to find out more? We can help.