Resale Investment Condo

Why everyone should have at lease ONE investment property, really! Let's breakdown the numbers.

An investment property requires 20% downpayment to finance and closing costs are approximately 3% of the purchase price which totals to 23% for our analysis purposes.

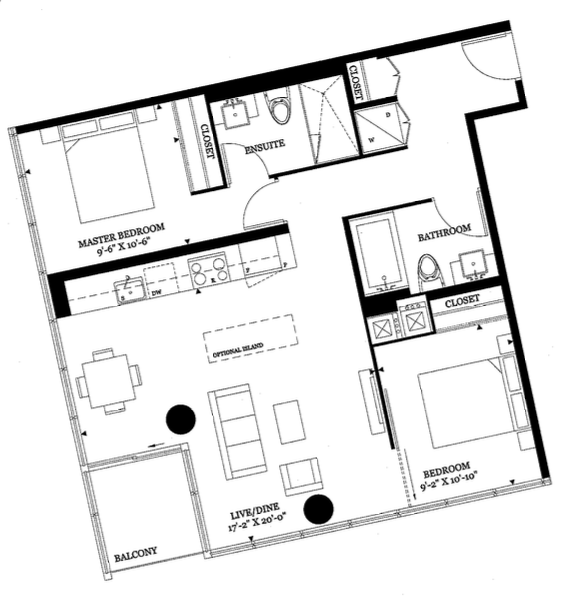

Let's use an example of buying a $500,000 resale investment property, most likely an investment condo in Toronto.

Required capital is $115,000 (23% of $500,000). For now we'll assume the $115,000 is not borrowed from a line of credit, it is from personal savings or investments.

In 5 years at 2% annual appreciation, the investment property would be valued at $552,040. The mortgage principal at renewal in 5 years would be $341,898 (borrowing at 3% amortized over 25 years). The difference ($210,142) is the equity built.

The initial capital investment $115,000 would be $210,142 after 5 years which is $95,142 in pre-tax profit ($19,028 per year or 16.5% return on investment).

Investment property, investment condo, pre-construction condo

Pre-Construction Condos Leveraging

Let's look at example of buying a pre-construction investment property for $500,000 as well. Let's assume in this case, the real estate investor has access to a secured line of credit HELOC on their home at prime+0.45% which is 3.45% based on today's interest rates. The cost to carry 20% down payment ($100,000) over 4 years which is a typical period of time to construct a condo is $287.50 (interest only) per month, which can be viewed as an "investment contribution" similar to regular monthly RRSP contribution. If the investment property appreciates at 2% annually in the 4 years which historically has shown stronger appreciation, the value of the investment condo at the time of registration would be $541,216. $41,216 in 4 years is 10.3% annual return on investment without having to maintain a property, deal with tenants or pay a mortgage. Keep in mind the interest on the borrowed $100,000 is a tax write off since it is used for investment purposes (Please consult a professional accountant as this is not intended to be tax advice). 5 years after the investment property registers, the condo would be worth $597,546 (at 2% appreciation) with a mortgage balance of $341,898, that's $255,648 in equity over 9 years or 13.5% annual return on investment.

investment property, investment condo, pre-construction condo

Click here to get your pre-construction investment guide

Advanced Investment Property Strategy

Initially, the real estate investor puts down 20% into the investment property and finances 80% of the property value. Over 5 years time frame and as the mortgage matures, based on 2% annual appreciation and mortgage paydown, the equity in the investment property is at approximately 50%! The real estate investor has 2 options at that stage:

Renew the investment property mortgage and continue paydown as originally planned

Pull some of the built equity and acquire another investment property

To determine what's best for the real estate investor, the following questions are to be addressed (hint: it is something we can help real estate investors with):

How much cashflow is required assuming the mortgages are paid to support desired lifestyle?

How many investment properties are required to achieve the above desired cash flow?

Which areas can the real estate investor invest in to achieve the desired cash flow in the shortest period of time?

4 Takeaways from leveraging an investment property:

With 20% equity into an investment property, the real estate investor's equity position is at approximately 50% with mortgage paydown and 2% appreciation at the time of mortgage renewal in 5 years

Rinse and recycle: in 5 years with mortgage renewal, the real estate investor can pull the built equity to acquire another investment property

Using borrowed funds is an advanced tax strategy (consult accounting professional)

2% appreciation is equivalent to 15+% return on investment. 2% might sound like a low number but it results in double digit return on investment!

Are the above numbers overwhelming and you want to invest in real estate? Contact us. We can help!