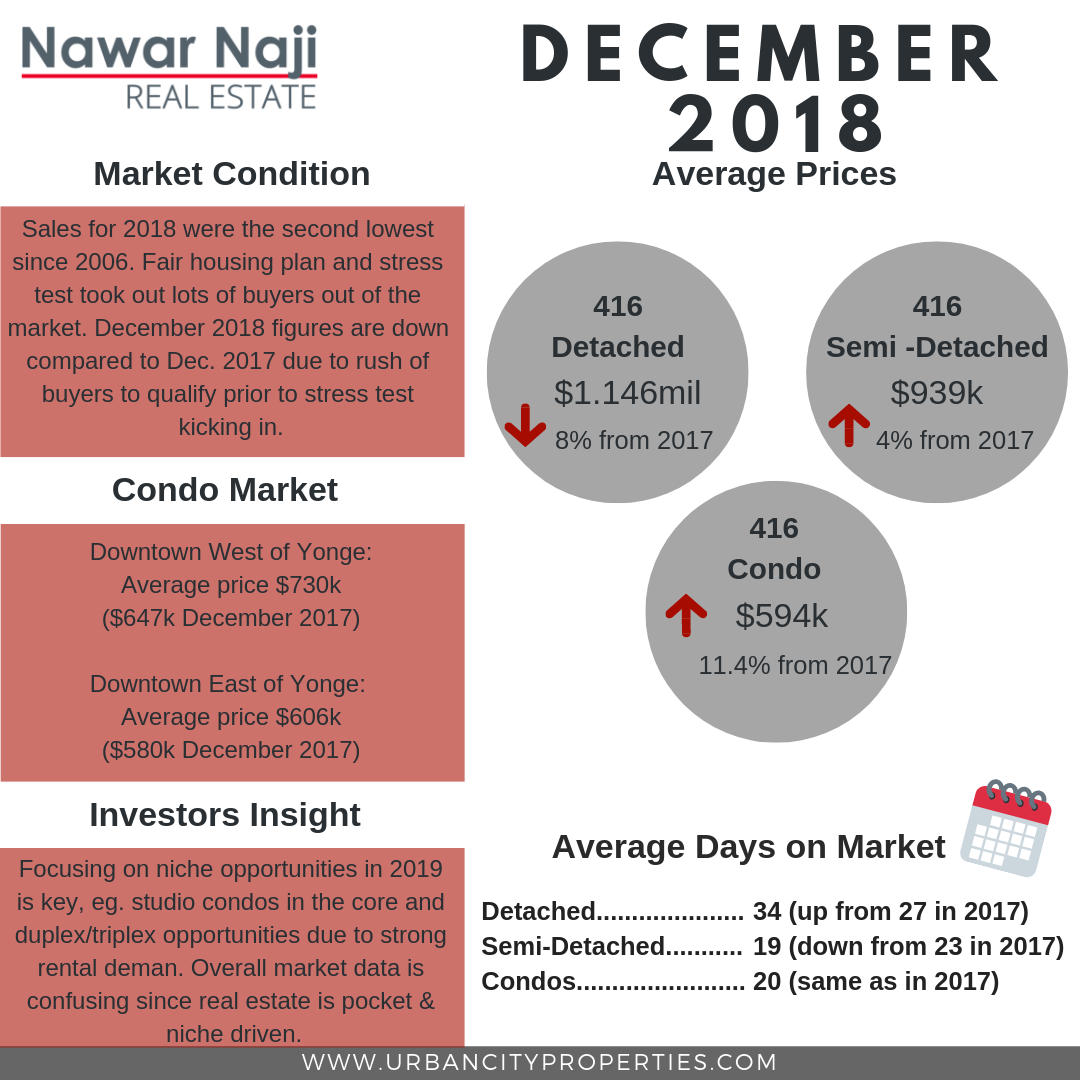

So the numbers are out and they do not look good. Sales were down by approximately 22%. There are three reasons why the sales figures for 2018 were the second lowest since 2006. First was the stress test that kicked in on January 1, 2018. Second, we've had multiple interest rate hikes. We've actually had five Bank of Canada increases since 2017 and the third reason is the Fair Housing Plan.

Now, specifically for the month of December the sales were down by 22% because last year, 2017, December 2017 there was a rush of buyers trying to get deals done before the stress test kicked in. So it's important to look at multi year trends as opposed to year to year because sometimes that doesn't tell you the full story and there are specific factors that could impact that month compared to the previous year.

Now here are my predictions for 2019 for the city of Toronto. In the condo market, I predict that the condo's will continue to appreciate but into the mid to high single digits and the reason for that is we have approximately 24,000 condo units being completed in 2019. This will also take off some pressure on the rental rates increase in the condo market. For the semi-detached, market in the city of Toronto, I think, I believe it will continue to be strong. For a couple of reasons. One, as the condo owners cash out, or I should say some of them because they've built a lot of equity over the last few years, and they condo prices have appreciated. Some of those condo owners will cash out and get into the semi-detached market. The other factor is the stress test will push down, will continue to push down some of these buyers from the detached to the semis. So I think that semi-detached market will continue to be strong for 2019. Now last but not least is the detached. I think that's because of the price point especially in the city of Toronto, that probably continue to appreciate around the inflation mark. So anywhere from 1.5% to 3% range for the 2019 calendar year.

One economic indicator that I monitor is the commercial vacancy rate. You might be asking why? The reason I monitor that vacancy rate which is currently between 1% and 1.4% is the companies moving downtown, companies wanting to be downtown and that reflects the strength of the job market in this city. And again if you look at the housing fundamentals, having good jobs, having good employment rates creates housing demands. So as we move forward into 2019 with a low vacancy rate in the commercial space, again there's lots of jobs, lots of people working downtown and that would create housing demand for living in the city and being in the downtown core.